How to become a Millionaire in 4 Steps

Well hello darling! My name is Victoria and I run the Life of your Dreams course where I teach women just like you how to achieve their wildest goals and create a new life of happiness, abundance, and success.

This post is a part of a series of posts all about building wealth and becoming a millionaire, so grab a snack and get ready to binge!

*this post contains affiliate links

You know what you need (in most cases) in order to create a happy, healthy, and abundant life? Money.

My husband and I started a financial journey 2 years ago, and in a very short period of time, we have totally done a 180 with our money. On this journey, I spent a lot of time studying millionaires. I wanted to know what separated the rich from the not so rich.

And honestly, after doing an exhausting amount of research, I am not intimidated by finances anymore and I truly believe that becoming a millionaire is easier than I once thought.

I’m going to try to break it down to you in a couple of easy steps how you can start stacking up money like millionaire do.

A few things to remember before I get into the phases of becoming a millionaire.

- It isn’t an overnight type of thing.

- You don’t need a million dollars to be happy or successful, and just because you have a million dollars absolutely doesn’t mean that you will be happy.

- There are many ways to make money these days, you just have to find what works for you.

- I don’t have a million dollars, and everything shared in this post is what I learned from thorough research and my personal experience of going from not being able to pay my bills to having thousands of dollars in the bank.

- You will have to make sacrifices.

How to become a millionaire phase 1: Knowledge, education, and motivation.

It’s going to be rather difficult to become a Millionaire or save large amounts of money if you aren’t educated about the resources that are available to you. If you are the point of your life where you are ready to make more money and save more money, you really need to gain some knowledge on the subject first.

Because financial education isn’t really stressed in school and many people don’t get the financial education from their parents, the most important thing you can do is gain as much knowledge as you can about finances.

Knowledge is power and the more you know about money, the less intimidated you will be when it comes to managing your money.

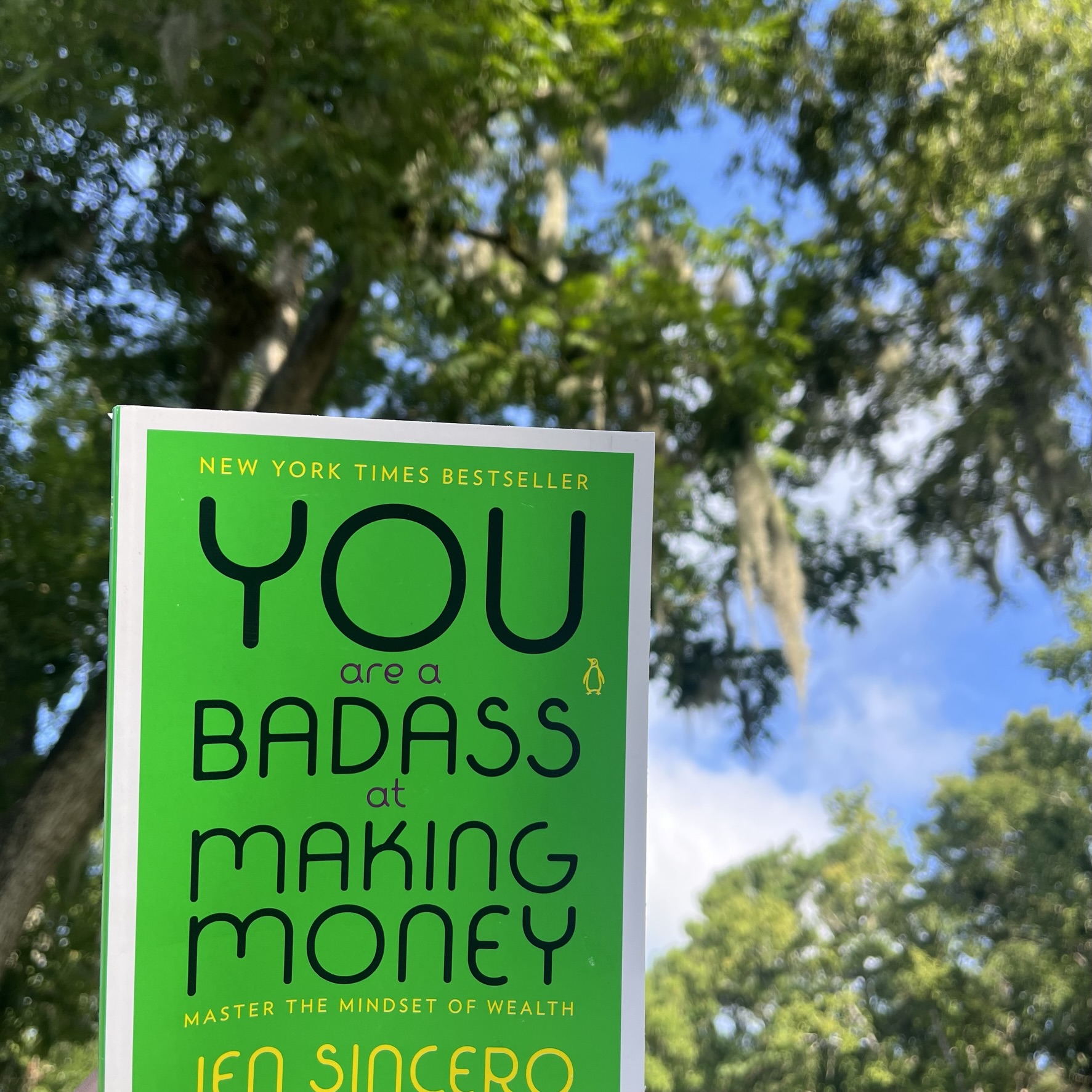

The easiest and most fun way to get some basic knowledge of how money works is to read books. I have 3 absolute must read books that completely changed my life and my outlook on money.

- You are a Badass at making money (motivating!)

- The automatic Millionaire

- I will teach you to be rich

- Getting a financial advisor (usually they are free)

Phase 2: Building your foundation.

If you are like me, you don’t even have a good financial foundation. My husband and I used to both work full time, but still have no money. This was due to our poor spending habits and lack of financial knowledge. We had to make a lot of serious financial shifts in order to get where we are today. A good financial foundation includes

- Steady, reliable income.

- The ability to pay all bills on time with no issues.

- A (minimum) $1,000 emergency fund, but the more the merrier. Ideally you should have a savings of at least a years worth of living expenses.

- Paying down your debt.

- Repairing, building, or maintaining good credit.

Perhaps the hardest part for the average person is setting the foundation for wealth building. Many people have credit card debt or student loan debt that makes them feel like they will be paying on forever. It also takes away confidence and can also be pretty intimidating.

I’ve heard so many people say that they don’t even look at their debt because it makes them depressed and regretful of their financial decisions.

Take some time every 6 months or so to have a look at your debt, your income, your credit score, and your expenses. This will keep you in check with your spending habits and helps you figure out what you should be doing better.

Phase 3: Creating and building wealth.

Once you have a juicy savings account and you feel financially secure, it’s time to start making some investments into your future. Having retirement accounts in place is very important because you want to make sure you are set up for long term financial success.

You should also start looking for ways to diversify your income. Millionaires have multiple income streams, which is brilliant if you ask me. So it might be time for you to start a side hustle or find ways to make extra money.

A few things you should spend some time researching if you’ve made it to stage 3:

- 401k and IRA accounts

- High yield savings accounts,

- Health Savings accounts

- Diversifying your income (you can read my post about millionaire income streams here)

Phase 4: Creating and building wealth through investments

Did you know McDonald’s makes the majority of their money money from real estate? I didn’t either.

Once you have your retirement accounts set up and you are contributing to them regularly, it’s time to start building your wealth. Investing in real estate, and the stock market are very popular. Investing directly into businesses is also another very popular way millionaires build their wealth.

This is a very basic overview of how to be come a millionaire. What you should take away from this post is that there are levels to this process and working phase by phase will be much easier and more satisfying for you!

I’ve read countless books on wealth building, becoming a millionaire, and investing. I have also watched many hours of content on YouTube and once I started implementing all of the information in my own life I have seen incredible results.

If I can do it, anyone can do it! You just have to be motivated enough and work hard in order to create the financial future that you want.